ERP stands for Enterprise Resource Planning. It’s a type of software that organizations use to manage day-to-day activities. An ERP system integrates various business processes, enabling seamless information flow across departments.

Brief History of ERP Systems

The concept of ERP originated in the 1960s, primarily to help manage manufacturing processes. Over the decades, it evolved to encompass all business functions, including finance, HR, and supply chain management ERP (Enterprise Resource Planning) systems have evolved significantly over time. The origins of ERP can be traced back to the 1960s when businesses started using software to manage inventory. The first systems were known as Inventory Management and Control systems. These early systems were designed to help businesses keep track of stock levels, orders, and deliveries, marking the first step toward integrated business management tools.

Why ERP is Important for Small Businesses

Streamlining Operations

For small businesses, efficiency is crucial. ERP systems streamline operations by automating routine tasks, reducing the time and effort required to manage business processes In the 1970s, the next major development was Materials Requirements Planning (MRP) systems. MRP software expanded the functionality of inventory control systems to include production planning, scheduling, and purchasing, specifically targeting manufacturing industries. These systems allowed companies to better manage their supply chains and meet production demands.

Enhancing Decision-Making

With real-time data analytics, ERP systems provide insights that aid in decision-making. Small business owners can make informed choices that contribute to growth and profitability.

Benefits of Implementing ERP

Cost Efficiency

Investing in an ERP system can lead to significant cost savings. By consolidating various functions into a single platform, small businesses can reduce operational costs By the 1980s, MRP II (Manufacturing Resource Planning) was introduced, offering even more capabilities, including shop floor control, financial management, and demand forecasting. This shift represented a move towards the integration of different business functions within a single software system, laying the groundwork for modern ERP.

Improved Productivity

Automation of routine tasks frees up employees to focus on more strategic initiatives. This boost in productivity can be a game-changer for small businesses The term “ERP” was first coined in the early 1990s as software vendors like SAP, Oracle, and JD Edwards began developing systems that could integrate a wider range of business functions beyond manufacturing. These systems included modules for accounting, human resources, customer relationship management (CRM), and more, providing businesses with a single platform to manage all aspects of their operations.

Better Customer Service

With an ERP system, businesses can manage customer relationships more effectively. Access to integrated customer data allows for personalized service, enhancing customer satisfaction In the 2000s, cloud-based ERP systems emerged, allowing companies to access ERP software through the internet rather than hosting it on-premise. This advancement made ERP more accessible to small and medium-sized businesses, as it reduced the need for expensive infrastructure and IT staff.

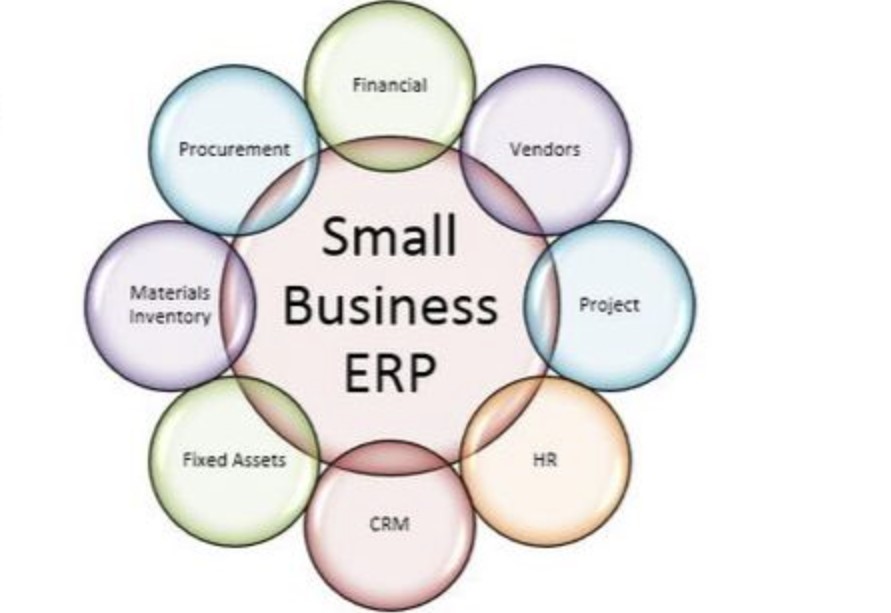

Common Features of ERP Systems

Financial Management

Most ERP systems include financial management modules that help track income, expenses, and budgeting What comes to mind when you think of financial management? Is it balancing your checkbook, managing your savings, or perhaps overseeing a company’s cash flow? Well, financial management encompasses all that and much more! In both personal and business contexts, financial management is the strategic planning, organizing, directing, and controlling of financial undertakings.

Human Resources

ERP solutions often feature HR management tools that streamline payroll, recruitment, and employee performance evaluations In today’s fast-paced world, where economic stability is often uncertain, mastering financial management is more crucial than ever. Whether you’re an individual trying to manage personal finances or a business aiming for profitability, financial management plays a pivotal role.

Inventory Management

Keeping track of inventory levels is crucial for small businesses. ERP systems offer real-time inventory tracking to prevent stockouts or overstocking Financial planning is the foundation of effective financial management. It involves setting financial goals, determining necessary resources, and mapping out a strategy to achieve those objectives. Think of it as creating a roadmap for your financial future.

Supply Chain Management

ERP systems help manage supply chain processes, from procurement to order fulfillment, ensuring efficiency and reducing delays Once you have a plan, controlling your finances means staying on track. This involves monitoring income, expenditures, and investments to ensure you’re sticking to the plan and making adjustments where necessary.

Types of ERP Solutions

On-Premise ERP

These systems are hosted on the company’s servers. While they offer greater control, they require significant upfront investment and ongoing maintenance Decision-making is another critical component of financial management. Whether it’s deciding where to invest, how much to save, or when to take on debt, every financial choice has long-term consequences.

Cloud-Based ERP

Cloud ERP solutions are hosted on remote servers, providing flexibility and scalability. They are often more affordable and require less IT management Budgeting is a core aspect of personal financial management. It helps individuals allocate their income toward expenses, savings, and investments, ensuring that every dollar has a purpose. A well-structured budget can make the difference between financial success and disaster.

Industry-Specific ERP

Some ERP systems are tailored for specific industries, such as healthcare or manufacturing. These solutions address unique industry challenges One of the most important goals of personal financial management is to save and invest wisely. Building an emergency fund, investing in stocks, bonds, or real estate, and planning for retirement are essential for long-term financial security.

How to Choose the Right ERP for Your Small Business

Assess Your Business Needs

Begin by identifying your specific business requirements. What processes need improvement? What features are essential Effective financial management involves keeping debt in check. This includes understanding interest rates, knowing when to consolidate loans, and avoiding unnecessary borrowing. Before implementation, conduct thorough research. Create a detailed plan outlining objectives and timelines.

Data Migration

Migrating data from existing systems to the new ERP can be challenging. Ensure you have a clear strategy to maintain data integrity.

Training Employees

Invest in training to ensure employees can effectively use the new system. A well-trained workforce maximizes the benefits of ERP.

Monitoring and Evaluation

After implementation, continually monitor the system’s performance. Regular evaluations help identify areas for improvement.

Challenges in ERP Implementation

Resistance to Change

Employees may resist the new system, fearing it will complicate their work. Address concerns through open communication and training.

Data Quality Issues

Inaccurate or incomplete data can hinder the effectiveness of ERP systems. Establish protocols for data entry and maintenance.

Cost Overruns

Budgeting for ERP implementation can be tricky. Be prepared for potential additional costs and ensure your budget accounts for unforeseen expenses.

Conclusion

Implementing an ERP system can be a transformative step for small businesses. With improved efficiency, better decision-making, and enhanced customer service, the benefits are substantial. However, it’s essential to approach the process thoughtfully, ensuring that the chosen system aligns with your business needs.

FAQs

1. What is the average cost of an ERP system for small businesses?

The cost can vary widely based on features and deployment. Expect to spend anywhere from a few thousand to tens of thousands of dollars.

2. How long does it take to implement an ERP system?

Implementation timelines can range from a few months to over a year, depending on the complexity of the system and the size of your business.

3. Can small businesses customize their ERP solutions?

Yes, many ERP systems offer customization options to meet specific business needs.

4. Is training necessary for ERP users?

Absolutely! Training is crucial to ensure users are comfortable and proficient with the new system.

5. What are the top ERP systems for small businesses?

Popular ERP solutions for small businesses include NetSuite, SAP Business One, and Odoo, each offering unique features tailored for smaller enterprises.